SmartSpend Bulletin™

Oracle Java Licensing Update

How to Mitigate Higher Costs on Your Next Renewal

Since Oracle’s shift to an employee-based Java SE subscription pricing model, Java customers have seen massive cost increases ranging from 2x to 10x (or higher). Here’s what you can do to prepare and minimize the financial impact on your Java estate.

Over the last four years, Oracle has consistently adjusted its approach to monetizing its expansive Java installed base. However, despite multiple tactics, the vendor has faced challenges in achieving sustained financial success.

Oracle’s latest model links Java SE subscription requirements to an organization’s total employee count. This is a departure from the traditional Named User Plus (NUP) and Processor licensing models. While simplifying some aspects of licensing, this shift will have significant cost implications for enterprise customers.

UNDERSTANDING ORACLE’S NEW JAVA LICENSING MODEL

Java subscriptions were historically based on Named User and Processor licenses. Named User licenses covered individuals with access to the software, while Processor licenses were tied to the number of processors in the server environment. In 2023, Oracle introduced a licensing model based on an organization’s total employee count, using an exceptionally broad definition of “employee.” It encompasses:

- Full-time, part-time, and temporary employees

- Employees of agents, contractors, and consultants supporting business operations

Oracle’s objective is obvious. The vendor has manipulated licensing metrics to support higher licensing counts and higher revenues across its customer base. Nearly every Java customer will now face higher licensing counts, regardless of actual access and usage within their business.

THE COST IMPLICATIONS FOR LARGE ENTERPRISE JAVA USERS IS SIGNIFICANT

Since Oracle’s shift to an employee-based Java SE subscription pricing model, Java customers have seen massive cost increases ranging from 2x to 10x (or higher). Additionally, Oracle retains complex conditions for virtualized environments, including partitioning limitations.

Beyond direct costs, customers face risks that could increase Java spending, including compliance issues from Oracle’s reliance on external sources like Google for employee counts, leading to discrepancies. The new model applies to all new customers, while existing customers under older models may renew but face pressure to transition, raising financial and audit risks. Oracle’s heightened audit activity and shifting terms during renewals further amplify these challenges.

ACTIONABLE STEPS TO REDUCE ORACLE JAVA COSTS

Many loyal enterprise customers are finding Oracle’s employee-based Java licensing metric to be an overreach. For some, the cost impact is untenable – or, at the very least, frustrating enough to trigger serious consideration of Java alternatives. Customers who avoid Oracle’s new metric this renewal cycle are well aware they will eventually be exposed to the full brunt of Oracle’s aggressive revenue tactics in one form or another.

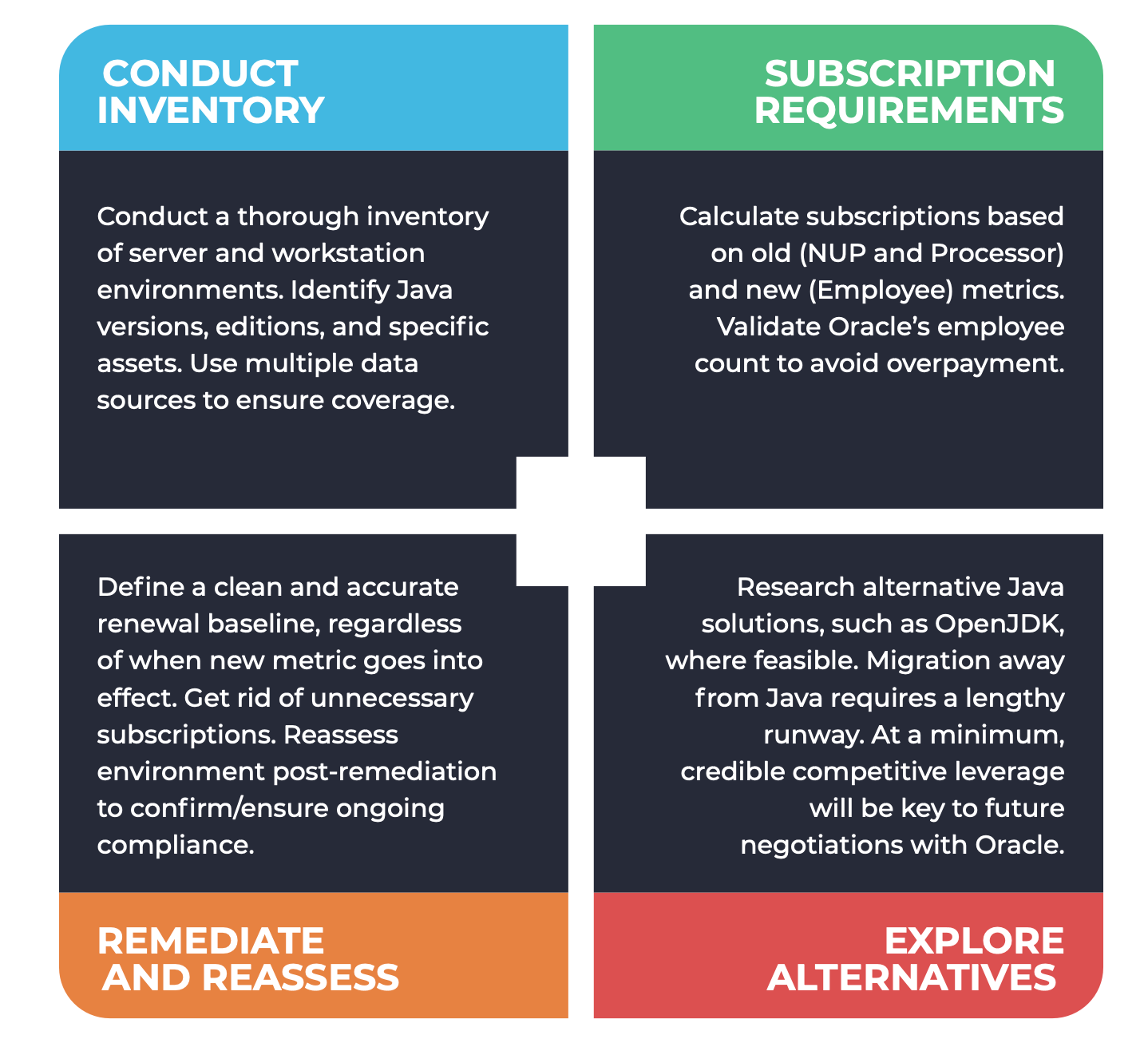

Existing customers must act swiftly to minimize cost and compliance risk across their Java deployment. Recommended actions include:

ACT NOW TO MINIMIZE HIGHER COSTS AND MAXIMIZE NEGOTIATION LEVERAGE

Failure to mitigate the potential cost impact of Oracle’s new Java licensing metric will cost enterprise customers millions of dollars – cost that is likely unbudgeted. NPI’s Oracle Java License Position Assessment Services help enterprises analyze the financial impact of Oracle’s new Java SE pricing model, determine strategies for minimization, and cost-model a potential move away from Oracle Java if feasible. To learn more about our services, contact us.

Case Study: Fortune 500 Financial Services Company

Situation

- Under pressure to switch to employee-based Java SE pricing at next renewal

- Attempted to reduce Java usage but encountered issues with identifying all deployments and determining licensing rights and limitations

Solution

- Engaged NPI to conduct comprehensive Oracle Java License Position Assessment

- Distinguished between commercial (paid) and non-commercial (free/bundled) Java instances

- Identified all instances of Java installations, providing detailed reports on servers and specific binaries

- Provided tailored advice on alternative solutions and licensing strategies to help client reduce its dependence on Java

- Eliminated unnecessary Java installations and negotiated effectively with Oracle, ultimately avoiding additional Java license purchases

Outcome

- Client successfully optimized Java usage resulting in cost savings of $2.5M

Download the SmartSpend Bulletin™

Share This Bulletin

Interested in Learning

More About NPI's Services?

Since Oracle’s shift to an employee-based

Java SE subscription

pricing model, Java customers have seen massive cost increases ranging from 2x to 10x (or higher).

Many loyal enterprise

customers are

finding Oracle’s employee-based

Java licensing metric to be an overreach.

Customers must

act swiftly to

minimize cost and

compliance risk

across their Java

deployment and,

if necessary, review

alternatives.

About NPI

NPI is a premier provider of data-driven intelligence and tech-enabled services designed specifically to assist large enterprises with IT procurement cost optimization. NPI delivers transaction-level price benchmark analysis, license and service optimization analysis, and vendor-specific negotiation intel that enables IT buying teams to drive material savings and measurable ROI. NPI analyzes billions of dollars in spend each year for clients spanning all industries that invest heavily in IT. NPI also offers software license audit and telecom carrier agreement optimization services.

NPI Vantage™ Pro is the newest addition to NPI’s solution portfolio – a platform developed specifically for IT Procurement Professionals to help them manage growing renewal portfolios, prepare for negotiations, and achieve world-class purchase outcomes. For more information, visit www.npifinancial.com and follow on LinkedIn.